This article will put into context present and past initiatives linked to sustainable finance. It explains the impact of the European Green Deal on the future business model of companies considering the new regulatory framework and evolving investor preferences.

Context: Towards a Greener Economy

Defining Sustainability

A commonly accepted definition of sustainability is ‘meeting the needs of the present generation without compromising the ability of future generations to meet theirs’. (Report of the World Commission on Environment and Development: Gro Harlem Brundtland, 1987).

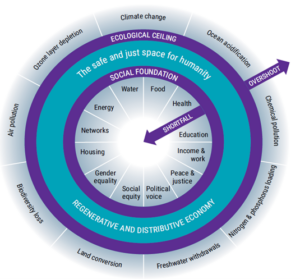

Linked to this definition is the economic DOUGHNUT, a model developed by Kate Raworth in 2017 that considers the optimal economic growth for people and the planet. According to this framework, economic growth should not exceed planetary boundaries or compromise human well-being. This model offers a fresh perspective on new economic indicators. However, critics argue that it is merely a collection of goals to address and nothing more.

Historical Perspectives on Sustainable Finance

Prior to the economic doughnut, John Elkington developed a theory called the ‘Triple Bottom Line’: People, Planet, Profit. In this concept achieving a good balance between the three parameters could also provide a right balance for a more sustainable economy. Critics of the ‘Triple Bottom’ argue that the lack of measurement and integration between the 3P’s do not allow a big shift for a deep transformation of the traditional economy to a sustainable economy.

These models prove that the concept of sustainable finance and more specifically sustainable investments is not new. The earliest record of sustainable finance even dates to the 17th century with religious groups. They are such as Methodists establishing guidelines for their followers over activities in which they should invest or lend.

In the more recent history, the first ethical funds, the Pioneer Fund was launched in 1928. Later, the United Nations released the Principles for Responsible Investments (PRI) in 2006 and the Sustainable Development Goals (SDGs) in 2015.

Although many initiatives have been taken in the past, no common framework was adopted by the market participants. Therefore, the European Commission presented an ambitious plan in December 2019: The European Green Deal.

The European Green Deal

The European Green Deal is a growth strategy that aims to transform the Union into a resource-efficient competitive economy, with zero net greenhouse gas emissions from 2050 onwards, and in which economic growth is disconnected from resource use. With this ambitious goal Europe wants to give a clear signal to investors regarding their investment choices.

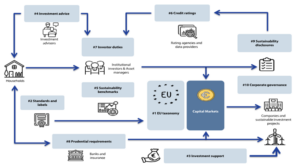

To finance sustainable growth, an EU Action Plan has been set up. The plan consists of 10 action points, aiming to leverage financial markets to address the issue of sustainability challenges.

Figure 1: EU Action plan, source : ECA, Based on the European Commission

The Action Plan is linked to 3 core objectives:

- More transparency on corporate governance & financial products,

- Redirect investments towards a sustainable economy,

- Incorporate sustainability as a risk prudential requirement.

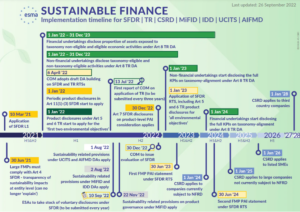

Figure 2 : EU Action Plan timeline, source the European Commission

Regulatory Framework

To meet the above goals, several key legislative regulations have been adopted.

The Taxonomy

The E.U. Taxonomy is a classification system that defines if economic activities are environmentally sustainable or not.

Activities are screened based on 4 criteria to be deemed sustainable:

- Substantial contribution to at least 1 of the 6 environmental objectives below:

- Climate change mitigation,

- Climate change adaptation,

- Sustainable use and protection of water and marine resources,

- Transition to a circular economy, waste prevention and recycling,

- Pollution and prevention control,

- Protection of healthy ecosystems.

- The economic activity does ‘no significant harm’ (DNSH) to any of the six environmental objectives,

- The economic activity meets ‘minimum safeguards’ such as the United Nations Guiding Principles on Business and Human Rights to not have a negative social impact,

- The economic activity complies with the technical screening criteria developed by the EU Technical Expert Group.

Note that taxonomy is still in the early stages of development. As a result, ESG (Environmental, Social, Governance) criteria have not yet reached the same level of maturity, and work is still in progress.

The Sustainable Finance Disclosure Regulation (SFDR)

Attracting private funding to help Europe make the shift to a net-zero economy will be key. Therefore, the regulator has set out how financial market participants must disclose information on sustainability. This adds an extra layer to traditional financial KPI’s in order to give a more global picture of a company.

The SFDR regulation aims to increase transparency and comparability of ESG information of companies. This helps investors to gain a clear perspective on the effective ESG level of a company and at the same time prevents greenwashing. Since January 2022, financial institutions, and non-financial institutions within the scope of the Non-Financial Reporting Directive (NFRD) are required to disclose their sustainability level.

The Reporting Directives aim to provide a comprehensive corporate reporting framework that includes both qualitative and quantitative information. This framework facilitates the assessment of companies’ sustainability impacts and risks. In January 2023, the Corporate Sustainability Reporting Directive (CSRD) will amend the directive on the publication of non-financial sustainability information by companies.

The CSRD has a dual objective:

- On the one hand, to extend the EU’s sustainability reporting requirements to all large companies employing more than 250 people (instead of 500 at present; the criteria of balance sheet total, EUR 17 million, and sales, EUR 34 million, still apply) and to all listed companies.

- On the other hand, to step up control of sustainability reports, even if this remains less stringent than that of financial reports.

This regulation affects many financial market participants such as banks providing portfolio management and investment advice, insurance companies providing insurance-based investment products, asset managers through collective investments in transferable securities management (UCITS) and through alternative investment fund managers (AIFMs).

Principal Adverse Impacts (PAIs)

PAIs are the key of the SFDR regulation. PAIs relate to any negative impact that investment decisions or advice might have on E.S.G criteria. The EU created a list of 64 PAI indicators, 14 of which are mandatory and must be disclosed, the remaining 46 are discretionary.

The mandatory indicators focus on a wide variety of environmental and social considerations. Note that the mandatory PAIs must be disclosed at entity and product level. At entity level, it is mandatory for financial market participants with 500 or more employees during the financial year to publish an annual PAI statement.

The following must be disclosed:

- Sustainability risks in investment decision making process or financial advice,

- Sustainable risk integration in remuneration policies,

- PAIs on sustainability factors,

- Precontractual disclosures on financial products may be affected by sustainable risks.

At product level, the SFDR splits products into 3 groups:

- Article 8 Products: products promoting social and/or environmental characteristics, and may invest in sustainable investments, but do not have sustainable investing as a core objective.

- Article 9 Products: products having a sustainable investment objective. What is a Sustainable Investment in line with SFDR?

- Article 6 Products: all other products

Under article 2 (§17) of the SFDR, a ‘sustainable investment’ is defined as an investment:

- In an economic activity that contributes to an environmental objective, or to a social objective,

- Provided that such investments ‘do not significantly harm’ any of those objectives,

- And that the investee company follows good governance practices.

EU Climate Benchmarks

A climate benchmark does not only consider financial criteria but also involves selecting and assessing companies that are actively reducing greenhouse gas emissions and transitioning to a low-carbon economy. Therefore, the EU Benchmark Regulation has been amended.

Two benchmarks have been defined:

- EU Climate Benchmark (EU CTB) : more diversification

- EU Paris-aligned Benchmark (EU PAB) : more strict miminum requirements (versus EU CTB). Highly ambitious climate-related investment strategies.

Moreover, benchmark administrators (as market participant) must meet the ESG disclosures to improve transparency.

The Sustainable Investing Framework

In addition to the traditional approach, providers of financial instruments have a large spectrum to develop solutions for investors.

The sustainable investment universe is based on the 3 ESG.

Methodology

One size does not fit all in the context of managing sustainable investments. Various continuously evolving approaches are used by investors, portfolio managers & investment product designers. Rather than a trend, integration of an ESG layer in the investment processes is becoming mainstream due to new regulation, investors demand or just as a tool to lower risks.

Below some of the most common approaches that are used:

- Exclusion:

The portfolio manager will screen and exclude companies/sectors/geographical parts of the world whose practices are not in line with ESG investing. These exclusion policies are generally based on international standards. To be efficient exclusions will be total or partial (for example: maximum 5% of the portfolio linked to extraction of fossil energies).

The advantage is that certain companies or certain sectors can be excluded from the investment universe. However, excluding a sector could have a big impact on risk-return adjustment of the portfolio and might be problematic for investors.

- Best in class:

Best-in-class refers to a selection of companies that are industry leaders in terms of ESG rating. This methodology, also referred to as ‘positive screening’, helps identifying companies that are actively working on improving their ESG rating or using sustainability to enhance their competitive advantage.

Portfolio managers/investors will not exclude a sector or a company a priori, but rather select the company with the best ESG score in the sector. For example, when the economical context is in favor of energy sector, the portfolio manager will select the company having the best ESG rating within the energy sector.

- ESG Risk limitation:

ESG risk limitation refers to a company assessment based on ESG risks. ESG risks are based on ratings composed of company sustainability disclosure.

- ESG integration:

This is a consistent integration of ESG criteria as part of the decision-making process. A top-down or bottom-up integration for adjusting financial forecasts, adjusting financial valuations, adjusting valuation models, …

- Thematic Investing:

This refers to identifying investment themes that can benefit of upwards ESG trends This strategy leans close to high conviction strategies with a clear focus on a theme like renewable energy, clean tech, well-being, …

- Impact Investing:

This strategy aims on both a positive financial return and a measurable impact. Impact investing consists of 3 components: the intention to make a positive impact, generating return and measuring the ESG impact. Microfinance is one of the examples of this approach.

- Active ownership strategies:

Utilizing ownership and voting rights to effect positive changes within companies.

Investment Process

A full or partial integration of ESG into the investment process will vary from one investment solutions provider to another. The Figure below shows the number and the kind of analysis needed in a full ESG integration investment process. It is important however to note that portfolio managers have the flexibility to tailor investment styles and approaches to meet their client’s needs.

Source: CFA institute 2018 in collaboration with PRI

This implies that if more investors prioritize environmentally friendly investments, their investment universe becomes smaller, which could potentially lead to liquidity challenges for high-carbon corporations in the future. Consequently, a liquidity gathering risk must be considered for high tax carbon corporation in the future.

The Suitability Assessment

To advise them correctly on sustainable investments, investments advisors have to collect sustainability preferences from their clients. Amendments to MiFID II and IDD Directives have been introduced to gather these preferences.

The first challenge is to understand and explain the concept of Sustainable Investing alongside the traditional information important for client portfolio allocation, followed by a summary of the client’s preferences.

The MiFID questionnaire has been amended with new questions:

- Does the investor want to express a sustainable preference?

- Does the investor want to invest accordingly to EU Taxonomy sustainable investments? If answer is yes, in which portion of the portfolio?

- Does the investor want to invest accordingly to SFDR sustainable investments? If answer is yes, in which portion of the portfolio?

- Does the investor want to invest accordingly to PAIs sustainable investments? The answer is yes or no.

Finally, when the clients’ preferences have been added to the traditional MiFID questionnaire, the investment advisor is able to advise his client with the universe based on client’s answers.

What Does That Mean for The Industry?

The EU provides a clear framework for assessing the level of sustainability of a company, a project and by extension of an investment. It creates a common language around green activities minimizing greenwashing.

- Investors can make the switch to ESG investments depending on their own beliefs and sensibilities within a legal framework providing a better transparency. They can make it partially or totally and even focus on a particular aspect of the ESG criteria.

Therefore, as investor, you decide what color you want your investments to be. From dark brown to light green. You also have the right to choose where you want your cursor positioned. A word of advice: greenwashing is a reality. Get informed!

- Investment product producers, Banks and Insurance companies will be discalified over time if they don’t offer a wide range of products to meet their customers’ expectations. In addition to the product range, your institution’s positioning needs to be clarified. Make your positioning tangible, without hype or promises. The question of differentiation from your competitors is key, given that ESG criteria will be the new standard.

A review of your business model is needed to make your positioning tangible

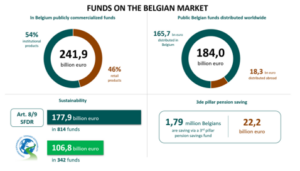

What does ESG Investments represent in Belgium (source BEAMA December 2022) :

Importance of Sustainable Finance and the Influence of Regulatory Initiatives

Exploring the past, present and future outlook of sustainable finance this article indicates its increasing importance. It emphasizes the significant influence of initiatives such as the European Green Deal, while highlighting the essential relationship between regulations and the changing priorities of market participants.

These efforts will not only have an impact on future business practices but certainly also influence our shared responsibility for the planet and society.

Written by Nicolas Fortomaris, Senior Manager Investments at Dynafin.