In an increasingly digital world, the banking sector faces a crucial question: how to adapt to the growing influence of crypto-assets and natively digital representation of value?

In recent years, cryptocurrencies, public ledgers, and tokenized assets have emerged as major innovations, redefining the boundaries of the financial systems. Their increasing adoption in the creator economy, everyday transactions and asset management, has drawn the attention of regulators, tech companies, and financial institutions.

A New Financial Reality

Crypto-assets like Bitcoin and Ethereum have evolved into stores of value, often compared to digital gold or digital oil. But their role extends far beyond being mere investment assets. They make possible the provably neutral “rails” upon which to build rapid and cost-effective global value transfer and the creation of innovative financial products such as stablecoins and asset-backed tokens.

For banks, the impact is significant. While some institutions have long ignored or rejected these new currencies and the networks they power, others have seized the opportunity to diversify their services and immerse themselves in the crypto ecosystem. Companies like Revolut, N26, Deutshe Bank, and Société Générale have become pioneers by offering crypto services to individuals and institutions. Meanwhile, an increasing number of financial entities are providing tokenization solutions for traditional assets like real estate or equities, allowing these assets to benefit from blockchain’s unique features: programmability, transparency, composability, and resilience.

Challenges and Opportunities Ahead

The evolution of crypto and natively digital assets and their growing adoption signal a paradigm shift that cannot be ignored. As blockchain technology matures, crypto-assets are poised to become essential components of global financial infrastructures.

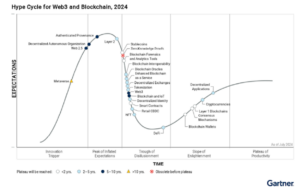

Recent analyses indicate that the technology is nearing widespread adoption. For example, if we look at the recent Gartner’s opinion for Crypto and blockchains, Stablecoins, Smart-contracts, wallets, and layer 1 blockchains are all going to reach the “plateau of productivity” in under 2 years.

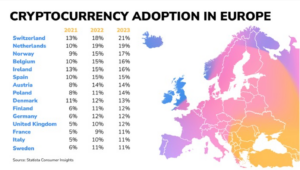

Other surveys show that many crypto owners would be interested in buying cryptocurrencies from their bank, or would take their business to banks that jumped into cryptos.

While financial giants like BlackRock and Société Générale have already begun leveraging tokenization and digital currencies, many other traditional financial institutions are looking at developing services on crypto assets technologies.

The European Regulatory Approach: MiCA and Beyond

However, the rapid adoption of a new public network of value by the banking and finance sectors also raises concerns, particularly regarding regulation and risk management. One of the key priorities of European authorities has been to ensure that the new possibilities offered by crypto rails do not become tools for money laundering or terrorism financing while also guaranteeing adequate protection for investors and consumers.

As a result, regulations have been introduced, starting with the Markets in Crypto-Assets Regulation (MiCA), adopted by the European Union in 2023. This regulation aims to create a harmonized legal framework for crypto-assets and associated services across the EU. MiCA applies to Crypto Asset Service Providers (CASPs), covering services such as custody, trading, crypto-to-fiat exchanges, and crypto portfolio management. Under this regulation, financial institutions must now be authorized and supervised by competent national authorities before offering crypto services.

MiCA also identifies 10 key activities that fall under regulation for crypto-asset service providers. Among these, certain activities are particularly relevant to traditional banks:

- > Custody and administration of crypto-assets on behalf of clients.

- > Exchange of crypto-assets for fiat currencies.

- > Execution of orders for crypto-assets on behalf of clients.

- > Management of crypto-asset portfolios.

- > Providing advice on crypto-assets.

These activities align closely with the traditional competencies of financial institutions, offering an opportunity for them to expand their service portfolios while adhering to the clear regulatory frameworks established by MiCA.

MiCA also imposes strict requirements on transparency and consumer protection. For instance, banks and CASPs must provide clear information about the risks associated with crypto-assets, including price volatility. Additionally, protecting client funds is a priority, requiring banks to ensure that crypto-assets held for clients are separated from their own funds.

Stablecoins, such as USDT by Tether and USDC by Circle, have also been a focal point. Under MiCA, these instruments must comply with strict rules regarding asset reserves and redemption rights, ensuring that each issued token is backed by an equivalent value in currencies or underlying assets. The goal is to maintain the stability of these assets while preventing systemic risks in financial markets.

DORA, AML/CTF and other regulatory considerations

Regulation does not stop there. Another key framework is the Digital Operational Resilience Act (DORA), which comes into effect in January 2025. DORA specifically addresses the operational resilience of financial institutions, including those operating in the crypto space. Its goal is to ensure that financial sector players, particularly banks and crypto service providers, can withstand cyberattacks, system failures, or service interruptions.

Besides MiCA and DORA, other European and local regulations apply to cryptos, like the EU governing the transfer of funds and crypto-assets within the European Union, the BE Regulation on the ban of promoting specific financial products to non-expert clients, or, depending on your exposure to digital assets or tokenized assets, different rules released by ECB/EBA/BNB/BIS/ESMA.

Finally, the taxation of income from cryptocurrency is another concern for investors.

Technological & operational Strategies for Integrating Crypto-Assets

The development of technological and organisational capabilities necessary for integrating crypto-assets can be approached internally or through external partnerships. An internal approach involves creating specialized teams to manage custody, exchanges, and the integration of blockchain services into existing banking systems. This requires expertise in key management, smart contract development, and regulatory compliance.

Conversely, external partnerships with technology providers, such as DFNS for custody or Bitpanda for white-label solutions, enable rapid implementation with reduced initial investment. Both approaches offer distinct advantages in terms of control, deployment speed, and innovation, depending on the bank’s strategic priorities.

Case Studies and Impact on European Banks

For European banks, adopting crypto-assets and complying with these new regulations require strategic planning and significant technological upgrades. Take Société Générale as an example: in 2023, it obtained a license to issue stablecoins under its own brand. In partnership with Forge, a blockchain-focused subsidiary, the bank launched a stablecoin that allows institutional clients to conduct transactions in crypto while meeting strict regulatory requirements. What they learned in the “early”days now allows them to deploy their stablecoin freely to anyone and to have a partnership with Bitstamp.

Caceis has partnered with Spiko to offer tokenized Money Market Funds.

And with Bitpanda, Raiffeisenlandesbank is the first traditional European bank to offer the full range of digital asset investments.

These initiatives demonstrate how traditional financial institutions can not only integrate into the crypto ecosystem but also leverage regulations like MiCA to secure and legitimize their position in this emerging field.

Conclusion

The integration of crypto-assets and networks into European financial institutions represents a pivotal moment in the evolution of banking and finance. These technologies, while offering immense transformative potential, require careful management to ensure market stability and consumer protection. Regulatory frameworks provide essential roadmaps, enabling banks to navigate this complex ecosystem while strengthening investor and user confidence.

Financial institutions that can leverage the benefits of blockchain and crypto-assets while adhering to these regulatory frameworks will position themselves as leaders in this new era of digital finance. With innovations such as stablecoins, tokenization, and decentralized finance, the future of financial services is being shaped by speed, transparency, and resilience.

By embracing this technological revolution, leveraging the trust they have built up, and balancing innovation with regulation, banks are poised to not only meet the expectations of new generations of users but also help redefine global financial infrastructures. European institutions stand at a strategic crossroads where decisive actions will allow them not only to secure their position in the crypto-asset sector but also to shape the future of finance when European Financial Markets are in dire need of unification. By acting now, they can ensure their leadership in a fully digital era of financial services.