SWIFT Global payments innovation – GPI has been designed to improve speed and increase security and transparency in cross border payments. Launched at the end of 2015 as a multilateral service agreement between banks, corporate treasurers discovered some benefits already;

- They gain same day use of funds

- Have access to their payment information which is transferred between parties and provides them greater transparency and predictability of fees.

Benefits of SWIFT GPI:

- FASTER payments

- End-to-end TRACKING

- Fee & FX TRANSPERANCY

- CONFIRMED credit

- Unaltered remittance INFORMATION

- REDUCED COSTS

We can distinguish three key features of SWIFT GPI:

- strong>GPI tracker

- GPI observer

- GPI directory.

SWIFT GPI tracker provides end-to-end tracking of payments being processed, such as tracking your online purchases through the platforms of the shipment services.

Swift GPI is already transforming cross-border payments: 50% of GPI payments are credited to end beneficiaries within 30 minutes, 40% in under five minutes, many in seconds.

GPI Feature in the picture: gSRP – Stop & Recall

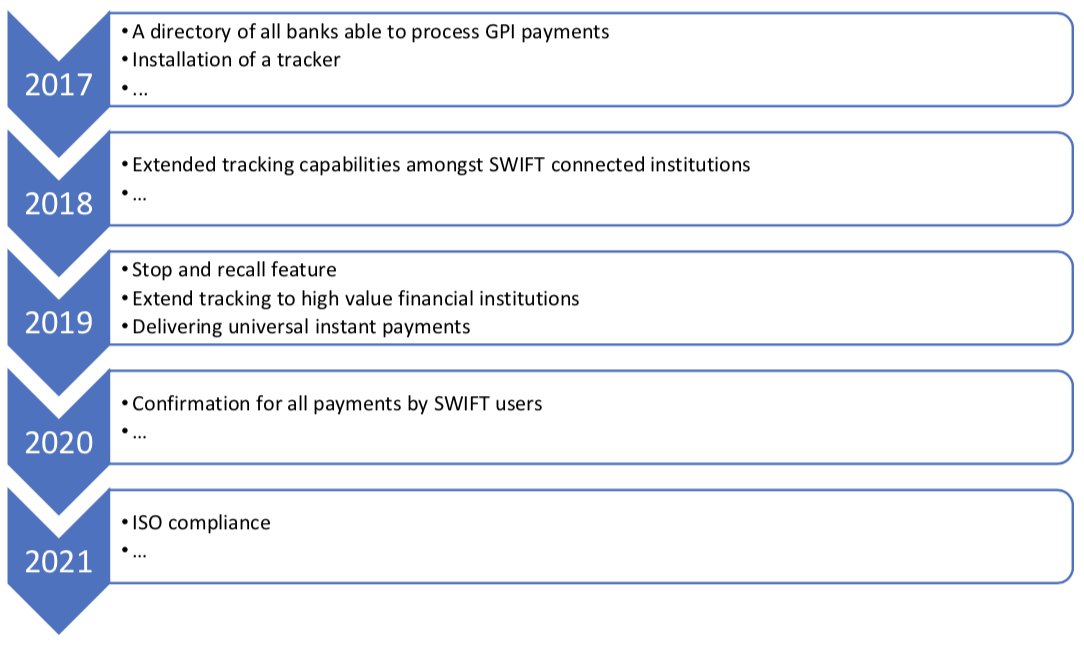

SWIFT gpi has expaned with some features already, one them being the Stop & Recall in November 2018. This enables a correspondent bank to stop the payment at any moment, wherever the payment is processed at that time along the chain. This is a huge improvement for banks in terms of fraud and error management.

Role of API’s

API’s (Application Programming Interface) are commonly known to us in the use of social media apps. They allow us to share whatever, whenever, e.g. using GPS technology to show everyone where we are and linking our photo’s to that same location on a map.

In payments however, API’s haven’t been around that long, but SWIFT GPI and API’s will rapidly improve the customer experience in cross border payment services. The higher demand for more details on payments and new regulations, such as PSD2, will make the call for API’s louder.

As the cross-border payment market still has a high potential due to high margins and great inefficiency of processing, it hosts high competition of FinTechs and banks, desperately seeking to enhance the client experience which only gets more challenging each day.

While the majority of GPI-enabled banks rely today on SWIFT messages to consult and update their payments’ statuses on the Tracker, we see more and more banks using APIs to access the Tracker. APIs offer faster and flexible ways to integrate tracking views anf details in bank back-office systems, customer channels and solutions for direct integration in end-customer systems.