1. TOWARDS SUSTAINABLE FINANCE

If the “return” aspect has always been predominant when it comes to investing in financial assets, there are of course other criteria that motivate investors to invest money.

Amongst these other criteria, sustainable finance, SRI[1] or ESG[2] criteria are considered increasingly important. The latter refers to the three essential factors for measuring a company’s sustainability and societal impact, highlighting the company’s level of commitment to sustainable development.

New intangible factors are therefore taken into account by the investor, who no longer decides to invest his capital in a company by taking into account its financial performance as the only selection criterion: the investor makes choices based on the company’s purpose, its human capital or its environmental impact, to name but a few.

Behind the ESG concept lies the integration of criteria necessary for the categorization of non-financial information about a company. This notion is often used interchangeably with that of sustainable investments. Indeed, by including elements such as the good governance of a company, or its impact on the environment, in the classic investment process, the investor has an additional insight into the company’s intangible assets, such as the value of its brand or its reputation.

Let’s say that like a company’s financial information only (and partially) reflects its past, it only provides a partial picture of its future.[3] The analysis of non-financial indicators therefore seems more appropriate when it comes to anticipating a company’s future, by examining its positioning in the market, its commitments on specific topics, the relations it maintains with stakeholders, etc.

In response to the growing interest of investors in sustainable finance, names such as SRI Core, SRI Broad, exclusion, inclusion, Best-in-Class, Best effort, shareholder engagement, positive or negative screening, solidarity savings[4] … have multiplied in recent years, not without creating some confusion in the minds of investors, even the most seasoned included.

2. CREATION OF A “GREEN” LEGAL FRAMEWORK…

While the European Directive 2014/95/EU[5] on non-financial reporting (transposed into Belgian law by the law of September 2017[6]) already required large undertakings to provide meaningful sustainability information[7], the European Union has decided to go one step further to address the lack of consistency and clarity regarding the consideration of ESG factors in advisory and investment decision-making processes.

By creating a legal framework around sustainable finance, the European Union aims first and foremost to honour the agreements reached in 2015; whether it be the United Nations Framework Convention on Climate Change (UNFCCC)[8] or the Paris Agreements[9].

It should also be noted that on December 11, 2019, the Commission presented the European “Green Deal”, a growth strategy aimed at making Europe the first climate-neutral continent by 2050.

In a recent publication on its website[10], the EU states that the financial sector has a key role to play in reaching these objectives by re-orienting investments towards more sustainable technologies and businesses, financing growth in a way that is sustainable over the long term and contributing to the creation of a low-carbon, climate resilient and circular economy.

As a result, in November 2019[11] the European Parliament and the Council published Regulation (EU) 2019/2088 “Transparency” on sustainability-related disclosures in the financial services sector, which establishes new transparency rules for financial market participants and financial advisors and imposes new requirements on them.

For greater transparency and to prevent greenwashing, a second regulation of November 27, 2019 (Regulation (EU) 2019/2089 known as the “Low Carbon Benchmark Regulation”[12]), which amends Regulation (EU) 2016/1011 and introduces new categories of benchmarks:

- The EU Climate Transition Benchmarks;

- The EU Paris-aligned Benchmarks and sustainability-related disclosures for benchmarks.

On December 17, 2019, a provisional agreement was also reached between the European Parliament and the Council of the European Union on the establishment of a framework to facilitate sustainable investment through a green taxonomy that will help to create a single nomenclature within the EU.

Published in June 2020, the (EU) “Taxonomy” Regulation 2020/852[13] aims to classify environmentally sustainable economic activities at EU level to enable the development of future EU policies for sustainable financing. This includes, amongst others, EU standards for environmentally sustainable financial products and, ultimately, the creation of labels that formally certify compliance with these standards across the Union.

3. … FOR GREATER TRANSPARENCY

It has to be said that the existing means for extra-financial publication were not sufficiently developed, due to a lack of harmonisation of the rules, thus creating distortions of competition, distorting the investment decision process and erecting obstacles within the internal European market.

However, Regulation 2019/2088 aims to establish harmonized rules on sustainability transparency in the financial services sector. It also aims to reduce information asymmetry in the relationship between principals and agents with regard to:

– The integration of sustainability risk;

– Consideration of adverse sustainability impacts;

– Promotion of environmental or social characteristics, and sustainable investments.

SUSTAINABILITY RISK POLICIES AND ADVERSE SUSTAINABILITY IMPACTS

In order to create more transparency about whether or not ESG factors are taken into account, the European Union requires financial market participants and financial advisors to publish on their websites[14] information about their policies regarding the integration of sustainability risks in their investment decision-making process (or insurance advice for insurance-advisors).

- Where considering principal adverse impacts in their investment decisions, financial market participants are now required to publish and maintain on their website a statement of due diligence policies on those impacts;

- Where they do not consider adverse impacts, they must also publish clear information explaining the reasons for doing so and information as to whether and when they intend to consider these negative impacts.

For their part, financial advisers[15] have the obligation to publish and maintain on their website information indicating:

- Whether they consider in their investment advice or insurance advice the principal adverse impacts on sustainability factors; or

- Information as to why they do not to consider adverse impacts of investment decisions on sustainability factors in their investment advice or insurance advice.

Of course, the requirements for financial market participants and financial advisors to act in the best interests of end investors are maintained. This means that in order to meet their obligations, they should incorporate into their procedures and continuously assess not only all relevant financial risks, but also all relevant sustainability risks that could have a material and relevant negative impact on the financial performance of an investment.

In order to assist Banks and Insurance companies, the European Commission has provided in its Guidelines on Non-Financial Reporting additional information[16] on the disclosure of non-financial information relating to their business model, their policies and due diligence procedures or the risks and risk management relating to the processing of non-financial data.

PRE-CONTRACTUAL DISCLOSURES AND ESG FINANCIAL PRODUCTS

Of course, contractual documents are not to be outdone, since financial market participants and financial advisors must describe how sustainability risks are integrated into their investment decisions, investment advice or insurance advice, as well as the results of the assessment of the likely impact of sustainability risks on the performance of financial products.

If a financial product promotes a sustainable investment objective[17] (ESG or equivalent), additional information must also be published in the pre-contractual documents, i.e. :

- The way in which environmental or social characteristics are respected;

- When a benchmark is designated, information on how the benchmark is adapted to these characteristics;

- The methodology used to calculate the index;

- How the designated index is aligned with the objective of the product and an explanation as to why and how the designated index differs from a broad market index.

In addition, for each ESG financial product, financial market participants must publish and maintain the following information on their websites[18]:

- A description of the environmental or social characteristics or sustainable investment objective;

- Information on the methods used to evaluate, measure and monitor the ESG characteristics of the product;

- Information on the main adverse impacts;

- Information on the alignment of the product with its benchmark, if applicable.

This information must be clear, succinct, understandable, accurate, not misleading and easily accessible to the public.

4. TAXONOMY, CLASSIFICATION AND REPORTING

Only after providing clear guidance on the methodology for determining which economic activities contribute to environmental objectives and do not significantly undermine other environmental objectives (Taxonomy), and with appropriate rules on benchmarks (Benchmarks), can financial market participants and their intermediaries communicate in a transparent manner on their sustainability policy or on sustainable investments (Transparency).

TOWARDS A COMMON CLASSIFICATION SYSTEM

In July 2020, EU members took a further step towards the implementation of the Commission’s Sustainable Finance Action Plan by approving the European Council’s position in favour of the creation of a green taxonomy. The taxonomy regulation establishes criteria for determining whether an economic activity is considered environmentally sustainable, in order to determine the sustainability of investments in this activity.

However, we will now have to wait until 2022, i.e. two years after the date proposed by the European Commission, to see the entry into force of this common classification system, which is supposed to ensure to redirect part of private financial flows towards activities considered to be sustainable and to limit the risks of greenwashing.[19]

To be labelled as such, these activities must contribute “substantially” to at least one of the EU’s six environmental objectives[20];

- climate change mitigation;

- climate change adaptation;

- the sustainable use and protection of water and marine resources;

- the transition to a circular economy;

- pollution prevention and control;

- the protection and restoration of biodiversity and ecosystems.

It will also be necessary to :

- Not cause “significant harm” to any of the other environmental objectives;

- Comply with robust and science-based technical screening criteria;

- Comply with minimum social and governance safeguards.

This last point also introduces a social dimension that has hitherto been relegated to the background.[21]

An EU-wide classification system should therefore allow to standardise and harmonise how to determine which economic activities can be considered sustainable.

IMPLEMENTATION[22]

This system will be developed through delegated acts and will be published in two batches: one on the climate-related objectives and one on the other four environmental objectives mentioned above.

This mean that Member States and the European Union, as well as financial market participants and companies, will only start to apply these rules once the corresponding delegated act has been published for one year. This will ensure that market actors have had sufficient time to familiarise themselves with the criteria.

Specifically:

The delegated act on the first two climate-related objectives (i.e. “Climate Change Mitigation” and “Climate Change Adaptation”) should be adopted by the Commission by 31 December 2020 and will therefore start applying as of 31 December 2021.

The delegated act on the remaining four environmental objectives should be adopted by the Commission by 31 December 2021 and will therefore start applying as of 31 December 2022.

To assist the Commission in the development of these delegated acts, a “Platform for Sustainable Finance” gathering various experts and stakeholders will be created. It will be tasked with providing advice on the technical screening criteria and several other relevant topics.

The Commission will also be advised by a Member State Expert Group to ensure the suitability and usability of the criteria. This process will facilitate the work of the Commission by providing advice on technical screening criteria that is scientifically robust and based on extensive consultation of all important stakeholders, including Member State experts.

It should be noted that while the above-mentioned dates for the publication of delegated acts remain hypothetical, the Commission expects financial market participants to prepare for the transition during the period left to Member States to transpose EU legislation into national law.

We will see under the heading “MIFID impacts” that the industry is already proposing to integrate ESG data into their IT systems only from January 2022 onwards.

The Financial/Insurance industry does not expect to be able to operationalise the integration of ESG factors in the analysis of its customers’ needs until the third quarter of 2022.

TECHNICAL SCREENING CRITERIA, NACE CODES AND CLASSIFICATION

In order to create a dynamic framework, in line with the economic reality of the market, the Commission called for the establishment of a platform on sustainable finance, the TEG[23]. This platform is an advisory body composed of experts from the private and public sectors that will assist the Commission in developing the technical screening criteria[24] that will flesh out the taxonomy and will be adopted by means of delegated acts. They will also advise the Commission on the further development of the EU taxonomy to cover other sustainability objectives, and on sustainable finance in a broader perspective.[25]

The technical screening criteria will be used to determine when an economic activity can be considered sustainable, and thus be considered taxonomically aligned.

According to the TEG, the assessment of eligibility under the taxonomy should be based on economic activity rather than sector or industry. The TEG’s recommendations are based on the EU’s NACE (Nomenclature of Economic Activities in the European Community) industrial classification system, and the TEG has established technical criteria for the selection of economic activities within priority macro-sectors. This classification system was selected for its compatibility with the statistical frameworks of EU Member States and international statistical frameworks and for its broad coverage of the economy.

Eligibility as a “sustainable enterprise” should be assessed on an activity basis rather than at the entity level. A key element in assessing the taxonomy is to define what part of a company’s activity can be considered sustainable.

DISCLOSURE OF CLIMATE-RELATED INFORMATION BY COMPANIES

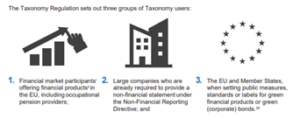

Financial market participants offering financial products in the EU, including occupational pension funds, are required to publish information on the taxonomy.

For each in-scope product, the financial market participant will be required to indicate :

- How and to what extent the taxonomy has been used to determine the viability of the underlying investments;

- To which environmental objective(s) do the investments contribute, and;

- The proportion of the underlying investments that are aligned with the taxonomy, expressed as a percentage of the investment, fund or portfolio. This disclosure must include details of the respective proportions of enabling and transitional activities, as defined in the Regulation.

As already mentioned, this information will have to be provided within the framework of existing pre-contractual and periodic obligations. These products are also subject to sustainability disclosure obligations under the Regulation on sustainability disclosures in the financial sector.

Financial products marketed or developed within the European Union, including pension products, will have to refer to the taxonomy. If the product is not required to provide full information on the taxonomy, it may include a standard disclaimer.

The Taxonomy Regulation also requires financial market participants to describe in their non-financial reports how and to what extent (in percentage terms) the investments underlying financial products are invested in environmentally sustainable economic activities. We note that, unless they aim to obtain a specific accreditation or label, there is no “correct” percentage of taxonomy-aligned securities in a fund.

In concrete terms, it will be necessary to wait for the publication of the delegated acts in order to know precisely what will have to be reported, but for the time being, financial market participants are advised to present in their report :

- How environmental sustainability strategies have been implemented in practice;

- A one-off calculation of the percentage of financial assets that are aligned with the taxonomy.

5. MIFID impacts

THE GOVERNANCE OF INVESTMENT PRODUCTS

On 8 June 2020, the European Commission published draft measures, integrating sustainability issues and considerations into the EU financial services regulatory framework, including the UCITS Directive, the Alternative Investment Fund Managers Directive (AIFMD), MiFID II, the Solvency II Directive and the Insurance Distribution Directive (IDD).

The draft delegated[26] act introduces a new definition of “sustainability preferences” in Delegated Directive 2017/593, which refers to the choice of the client or potential client as to whether a financial instrument which has as its objective sustainable investments or a financial instrument which promotes environmental or social characteristics as defined in the Disclosure Regulation should be integrated into his investment strategy.

In addition, the definitions of “sustainability risks” and “sustainability factors” provided for in the Advertising Regulation would be introduced in the delegated Directive.

The draft delegated act stipulates the obligation for investment firms to consider any preference for sustainable products as part of the needs, characteristics and objectives of clients if those investment firms identify at a sufficiently granular level the potential target market for the financial instruments and the types of clients for which they are compatible.

In making this assessment, investment firms would be required to consider whether the sustainability characteristics of the financial instrument are in line with the target market. This aspect would also need to be integrated more generally into product governance arrangements.

The draft delegated act also introduces the obligation for undertakings to ensure that the financial instrument remains compatible with the needs, characteristics and objectives, including any preference for sustainable products, of the target market when regularly assessing the financial instruments they create. If an inconsistency between the product and the target market is detected, undertakings should reconsider the target market and/or the governance arrangements for the given product.

ORGANISATIONAL REQUIREMENTS

The draft delegated act[27] amending delegated Regulation 2017/565 on organisational requirements also introduces the definitions of “sustainability preferences”, “sustainability risks” and “sustainability factors” in the delegated Regulation. Under the draft delegated act, investment firms will be required to consider sustainability risks when establishing, implementing and maintaining risk management procedures that identify risks related to the firm’s activities, processes and systems.

When making sustainability assessments and providing suitability reports, investment firms should take into account, in the selection process for recommending financial products to their clients, the risks, costs and complexity of the financial instruments, as well as any sustainability factors.

The draft delegated act also requires companies to prepare a report for the client explaining how the investment recommendation meets their sustainability preferences, as well as their investment objectives, risk profile and ability to bear losses.

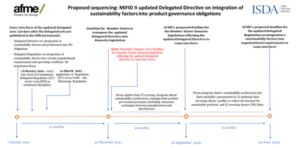

In view of this, AFME[28] and ISDA[29] have proposed to integrate the new Directives and Regulations in a sequential way, in order, on the one hand, to allow Member States to transpose European legislation into their national laws and, on the other hand, to allow time for the different market players to take the necessary steps to implement these new rules in their systems and processes.[30]

6. CONCLUSION

The concept of extra-financial information is not new, and consumers already have a whole series of tools to help them make investment choices based not only on the profitability of a company or a product. However, these indicators suffer from a lack of harmonization and consistency, and it is easy to get lost in front of the abundance of products labelled “sustainable”.

By creating a strict legal framework, the European Union wants to establish a taxonomy common to the different member states. This classification, based on reference indices, aims to create more transparency and to direct the investor to the right product.

Clearly, the financial sector has an important role to play in this, by being able to label the investment products it distributes according to taxonomy, and by distributing them while taking into account the interest of the consumer in so-called sustainable products. The implementation of such a process is complex and will impact the IT systems of financial companies.

But beyond the desire for harmonization, the European Union wants above all to redirect investments towards more sustainable technologies and businesses, with the Paris Agreements and the Green Deal in the line of sight. However, while environmental criteria were still at the center of attention at the end of 2019, the health crisis that hit 2020 has relegated climate issues to second place.

Since the transposition of the various European directives is done through so-called “Regulatory Technical Standards”, it is assumed that once the COVID storm has passed, the European Union will focus on mobilizing finance for sustainable growth.

REFERENCES

[1] Socially Responsible Investing

[2] Environmental, social, and governance

[3] Benjamin Legrand, L’information non-financière : analyse de son appréhension et de sa perception par les acteurs du monde financer, Université catholique de Louvain, 2016.

[4] Philippe Zaouati, Investir “responsable” : En quête de nouvelles valeurs pour la finance, Editions lignes de repères, 2009, p. 83

[5] https://eur-lex.europa.eu/legal-content/FR/TXT/?uri=CELEX%3A32014L0095

[6] http://www.ejustice.just.fgov.be/mopdf/2017/09/11_1.pdf#page=86

[7] https://www.corporategovernancecommittee.be/sites/default/files/generated/files/page/brochure-inf-fr-final-2-3-2018-print_0.pdf

[8] https://undocs.org/fr/A/RES/70/1

[9] https://unfccc.int/sites/default/files/french_paris_agreement.pdf

[10] https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance/what-sustainable-finance_fr

[11] https://eur-lex.europa.eu/legal-content/FR/TXT/PDF/?uri=CELEX:32019R2088&from=fr

[12] https://eur-lex.europa.eu/legal-content/FR/TXT/PDF/?uri=CELEX:32019R2089

[13] https://eur-lex.europa.eu/legal-content/FR/TXT/PDF/?uri=CELEX:32020R0852&from=F

[14] Article 4, § 1 of Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability reporting in the financial services sector.

[15] Article 4, § 5 of Regulation (EU) 2019/2088

[16] Communication from the Commission, Non-financial Reporting Guidelines: Supplement on Climate Related Information (2019/C 209/01)

[17] Article 8 of Regulation (EU) 2019/2088

[18] Article 10 of Regulation (EU) 2019/2088

[19] In practice, greenwashing occurs when an organization presents misleading or inconsistent information that makes it appear more environmentally responsible than it is.

[20] Article 9 of Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on establishing a framework to facilitate sustainable investment and amending Regulation (EU) 2019/2088

[21] Whereas 34 and 35 of Regulation (EU) 2020/852

[22] https://ec.europa.eu/commission/presscorner/detail/fr/qanda_19_6804

[23] Technical Expert Group, the platform on sustainable finance, as described in Article 20 of Regulation (EU) 2020/852.

[24] Article 19 of Regulation (EU) 2020/852

[25] The Taxonomy Regulation requires the European Commission to regularly review all technical selection criteria and, in particular, to review “bridging” activities under Article 6 of Regulation (EU) 2020/852, paragraph 1 bis, at least every three years.

[26] https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/12067-Strengthening-the-consideration-of-sustainability-risks-and-factors-for-financial-products-Directive-EU-2017-593-

[27] https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/12068-Strengthening-the-consideration-of-sustainability-risks-and-factors-for-financial-products-Regulation-EU-2017-565-

[28] Association for Financial Markets in Europe

[29] International Swaps and Derivatives Association

[30] https://www.isda.org/a/JDmTE/ISDA-and-AFME-response-to-the-European-Commissions-MiFID-II-delegated-acts.pdf